In late October 2020, the Health and Human Services, Labor, and Treasury Departments finalized the Transparency in Coverage rules. The purpose of these regulations is to provide healthcare consumers with crucial pricing and quality information that will empower them to make more informed decisions about their personal healthcare journey.

Below, we’ve broken down exactly what the Transparency in Coverage rules mean, in addition to who is impacted and how it relates to the No Surprises Act.

Transparency in Coverage Rules

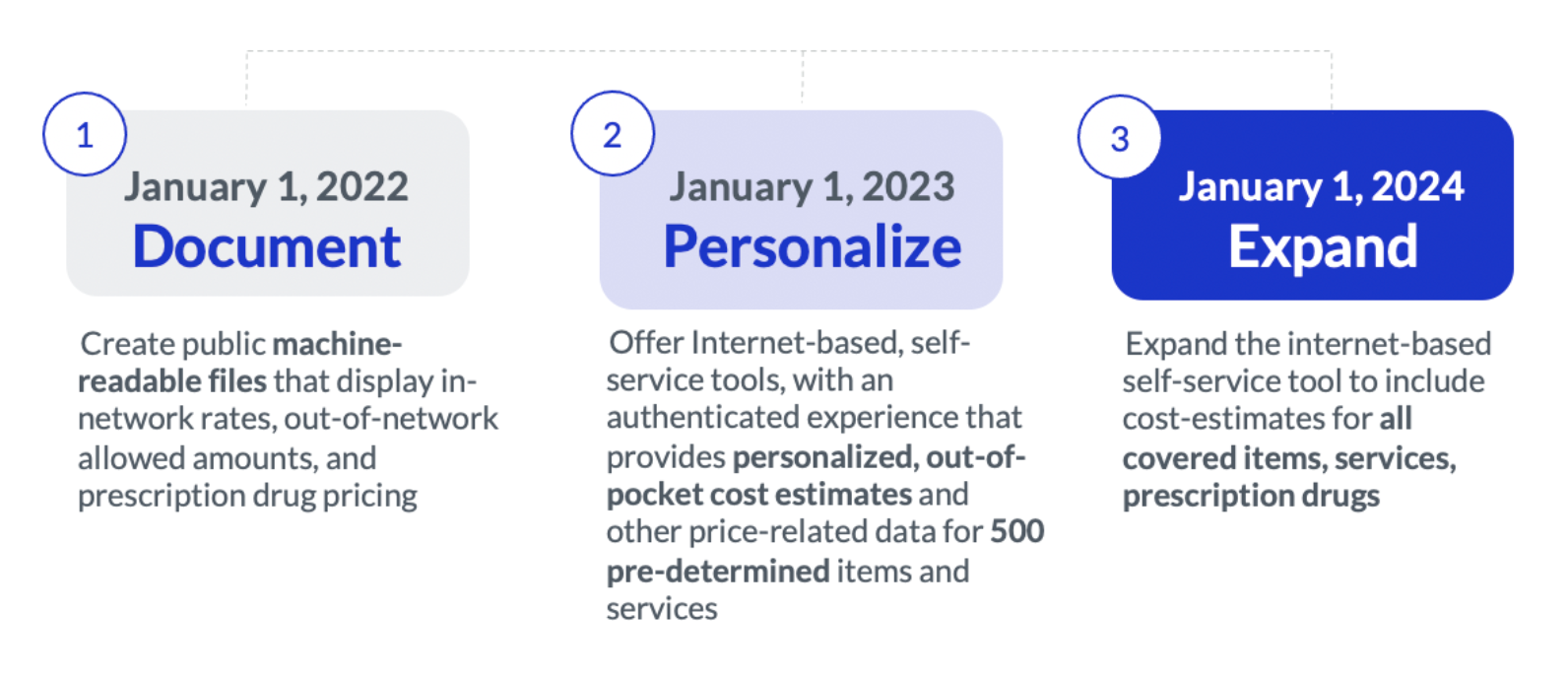

Under Transparency in Coverage, there are two different kinds of required disclosures: public disclosures and plan participant disclosures. These rules will be implemented in phases, over the course of about three years, beginning with the public posting of pricing data and progressing to a more personalized transparency experience for plan members.

Public Disclosures

Starting January 1, 2022, health plans and issuers (insurance carriers) will need to make the following information available to the public.

- In-network provider negotiated rates for all covered items and services

- Historical data that shows both billed and allowed amounts for all covered items and services set by out-of-network providers, including prescription drugs

- Negotiated rates and historical net prices for prescription drugs set by in-network providers

These details should be posted on the internet in a machine-readable format.

Plan Participant Disclosures

Starting January 1, 2023, health plans and issuers must provide the following information for 500 shoppable items and services, such as imaging services, laboratory tests, elective surgical procedures, and preventive screenings like mammograms and colonoscopies:

- Estimated cost-sharing: How much a patient is expected to pay for an item or service

- Accumulated amounts: How much a patient has contributed to their deductible and out-of-pocket maximum, in addition to how close they are to any treatment limitations

- Negotiated rates: The dollar amount a plan or issuer has agreed to pay an in-network provider for an item, service, or prescription, in addition to underlying fee schedules

- Out-of-network allowed amount: The maximum amount — or an accurate estimate — a plan or issuer will pay for an out-of-network item or service

- Items and services list: Everything that’s covered in a bundled payment agreement

- Coverage prerequisites: A notice alerting patients to the fact that a certain item or service requires a prerequisite, such as a prior authorization or step therapy

- Disclosure notice: A notice disclosing the following information to patients: balance billing, a disclaimer about the difference between actual and estimated charges, and whether or not co-payment assistance and other third-party payments are included in calculations for the patient’s deductible and out-of-pocket maximum

Participants should be able to view these details both via an online self-service tool and, if requested, paper format. Starting January 1, 2024, the details above must be available for all items and services, in addition to the original 500.

Who’s Impacted?

The following plan types must comply with the Transparency in Coverage rules: non-grandfathered group health plans, including employer-sponsored plans, multiemployer plans (e.g., Taft-Hartley plans maintained by unions), and multiple employer plans, such as association plans; individual insurance providers like the Health Insurance Marketplace; and non-federal governmental plans, such as those sponsored by municipalities and school districts. These entities must comply with the disclosures above in order to maintain compliance.

These rules will not apply to: grandfathered health plans, which are plans that were created on or before March 23, 2010; group health plans that are solely for excepted benefits, like onsite medical clinics, employee assistance plans, and dental and vision plans not integrated with group health plans; and account-based plans like health FSAs and HRAs.

It’s also important to note that there’s a difference of burden in liability between fully-insured and self-insured health plans.

Fully-Insured

Both the issuer (or insurance carrier) and the plan are subject to the Transparency in Coverage rules. Typically, the issuer will contractually assume sole responsibility for required data disclosures, meaning the plan has no liability. However, this is not a guarantee. If they don’t do this, the plan will be liable to some extent, or even completely. Fully-insured employers should make sure to have a comprehensive discussion with their issuer to make sure both sides are in agreement about who will be taking on responsibility for data disclosure.

Self-Insured Plans

The plan itself, or the plan sponsor, is responsible for complying with the new transparency regulations. In some cases, self-insured plans may contract with a third-party administrator (TPA) to provide the required disclosures in the necessary electronic and paper formats. However, the plan or plan sponsor is still liable if the TPA isn’t compliant.

The No Surprises Act

Signed into law on December 27, 2020, the purpose of the No Surprises Act is to protect patients from “surprise bills” — significant and unexpected out-of-pocket medical bills that occur either because the patient was experiencing an emergency, in which case they weren’t able to choose in-network providers, or when an in-network provider chooses out-of-network colleagues to assist with a procedure, a decision patients typically aren’t privy to until they see it reflected on their bill (e.g., when an in-network physician chooses an out-of-network pathologist).

On January 1, 2022, part one of the No Surprises Act will go into effect — providers will no longer be allowed to bill patients for an amount higher than the in-network cost-sharing stipulated by the patient’s insurance. There are a few exceptions, including ground ambulance transport. This new policy also allows for arbitration in the case that an out-of-network provider wants to challenge the health plan’s financial contribution to a specific bill. But, the main point here is that the burden of price negotiation is placed on the provider and the plan, rather than the patient and the provider.

As part of the Act, health plans must offer an internet-based price comparison tool, a regularly updated and verified database of contracted providers, accurate and up-to-date provider directories, an advanced explanation of benefits for scheduled services, and an insurance card listing plan-specific information. However, these components of the No Surprises Act will not be enforceable on January 1, 2022. The dates they will go into effect, in addition to further implementation guidance, have yet to be defined and will be determined in future rulemaking.

Ultimately, the No Surprises Act and Transparency in Coverage are completely separate. While the No Surprises Act does have some high-level recommendations about transparency, the main focus is on requirements between providers and health plans that aim to prevent or reduce surprise billing for patients.

Future Outlook for Transparency

Regardless of the specific rule, transparency regulations intend to make the experience of searching for cost-effective, high-quality care simple and friction-free. Promoting price transparency and standardizing its definition is a critical first step to achieving that intent. However, for the vision to be fully realized, price transparency must be complemented by other capabilities such as detailed quality data, engagement fundamentals, and motivators that incentivize individuals to take control of the way they seek care.

In future posts we will define not only how Castlight will align its complete navigation offering to help employers and health plans achieve compliance, but how to go beyond compliance to create a future-proof transparency and care guidance experience.

For health plans interested in learning more about how Castlight can help address Transparency in Coverage, visit castlighthealth.com/health-plans/. For self-insured employers, reach out here.